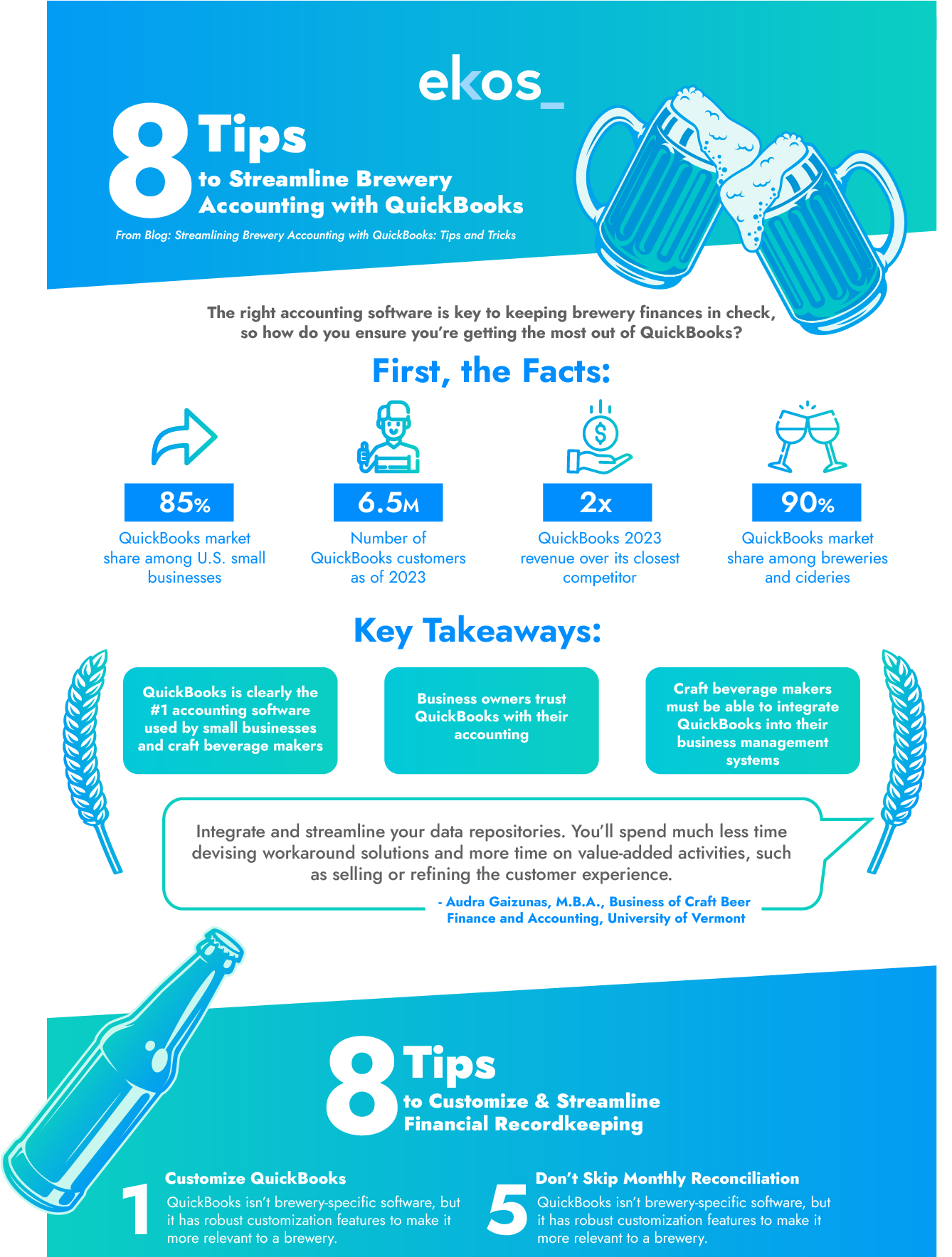

When running a brewery, the quality of your beer undoubtedly needs to be a top priority. However, effective brewery management is impossible without keeping the finances in tip-top shape. That requires the right accounting software. And it’s nearly impossible to argue against QuickBooks, which has an 85% market share among U.S. small businesses for a reason.

QuickBooks combines comprehensive features that help breweries and other businesses keep track of all their finances with relative ease of use. Still, there are plenty of features that may not be obvious to a brewery just starting to get its financials in order.

Ultimately, QuickBooks is not a brewery-specific software. Any onboarding you’ll get from the QuickBooks team is general, requiring some additional knowledge and insights to make it relevant to your specific business. Optimizing your brewery accounting with QuickBooks can be efficient as long as you consider these tips and tricks to help customize and streamline your financial recordkeeping.

Tip #1: Leverage QuickBooks Customization Features to Categorize Expenses

Because QuickBooks works across multiple industries, it has built plenty of customization features for individual businesses to optimize their own platform. Taking advantage of these customizations should be a top priority for any brewery looking to optimize its accounting.

For example, you can utilize the customization features to categorize your expenses and make them more relevant to brewing. That ensures a clearer financial picture, enabling you to run reports that help you understand at a glance where your money is flowing. You can also build custom reports, which help to streamline processes like the Brewer’s Report of Operations.

Finally, and more comprehensively, you can use QuickBooks to customize your chart of accounts, including liabilities, income, assets, and expenses. Consider, for instance, setting up different departments for various types of assets to more comprehensively and accurately track any changes in the values of those assets.

Tip #2: Set Up Items for Every Product You Sell

When it comes to accounting, QuickBooks organizes itself around items that describe the products and services your business sells. Especially in the beginning, it might seem simplest to set up one item for all your beer and adjust from there. But the platform is at its best when every product you sell is its own item you can track.

More specifically, QuickBooks enables you to set up four types of items:

- Inventory items, which form your end product. Every recipe, and every quantity of that recipe, should be its own product.

- Non-inventory items, which are smaller products you cannot inventory, like some of the intangible materials you need to produce your beer.

- Service items, which aren’t typically relevant to breweries unless you offer some tangential service to your beer customers.

- Bundle items, which are a collection of products you sell together. Think of a six-pack or a sampler of multiple recipes.

Once you set up your products in this fashion, QuickBooks becomes a lot more handy. You can now create invoices and purchase orders quickly while running dedicated reports on how each product is performing in terms of expenses and revenue.

Tip #3: Use Advanced Reporting Tools to Track Your Sales and Monitor Financial Health

Even in their most basic use cases, the reporting features within QuickBooks can be powerful. Basic financial reports, especially when you’ve set up customizations and detailed items, give you a quick snapshot of your business. Once you add advanced reporting capabilities, the platform’s benefits truly begin to shine.

Related: Three Brewery Accounting Best Practices

Through advanced reporting, you can keep a close eye on your sales and assess your brewery’s overall financial health at any point. You can even monitor your inventory levels. And of course, you can customize your reports to get exactly what you need anytime you need it. The system’s unique column control tool helps you get that snapshot for even the most unusual financial reports.

Tip #4: Integrate a Payment Processing System to Streamline Your Transactions

QuickBooks might be an accounting software, but its integrations with other platforms are game-changers. For example, users can integrate the software with any number of payment processing systems to reduce errors, streamline transactions, and ultimately build a better financial process.

The list of payment processing systems integrating directly with QuickBooks is long. PayPal, Square, and Flint are just some of the more popular solutions. From point-of-sale to e-commerce payments, these systems enable transactions to flow directly into the software.

Even better, you can integrate payment systems with your invoicing process as well. Whether you’re charging local restaurants for the kegs you deliver or want to improve the financial management of your supply chain, integration further increases accuracy and efficiency for the larger non-consumer-based payments you’ll need to manage.

Tip #5: Reconcile Your Accounts Every Month

One of the most beneficial features of QuickBooks is its ability to connect your business bank accounts with your accounting software. This ensures accurate bookkeeping—as long as you know exactly how to ensure your books and bank accounts remain in alignment.

Fortunately, the system has an integrated option in place to accomplish just that. Through the Reconcile tool, you can choose any of your accounts, along with the account balance and date from your bank statement, and then walk through the process of matching your bank transactions with your QuickBooks record. It’s a simple, guided process to catch any misaligned funds early to proactively correct the mistake.

But the system doesn’t offer any guidance or automation that dynamically reconciles on your behalf. That means you’ll need to go in, ideally every month after you receive your bank statement, to reconcile your individual accounts. This regular cadence ensures that small mistakes don’t become more difficult to catch or balloon into larger misalignments over time.

Tip #6: Set Up Recurring Transactions for Your Ongoing and Predictable Expenses

Every brewery has them: the predictable expenses that don’t change over time. They’re usually recurring, such as your business insurance, building leases, or inventory items you’ll always need. Entering them manually into your accounting software can quickly turn into a headache, which is why the recurring transactions feature is so helpful.

Related: Brewery Accounting Made Easy: Software Solutions for Brewers

More specifically, QuickBooks allows you to set up three types of recurring transactions:

- Scheduled creates a series of transactions that automatically happen at the same time for the same amount every month. Examples include rent, loans, and insurance.

- Unscheduled are transactions that you know to be recurring but not exactly when or for how much. An example might be an ingredient for a recipe you know you’ll need, but demand dictates the timing and amount. Once created, they’ll require a manual kickoff each time to start.

- Reminders are not their own transactions but simply send a notification when a recurring transaction might be necessary. This feature is best for complex transactions without a set schedule that you don’t want to start from scratch each time.

Each option can be helpful for various types of brewery-related transactions. Setting up a network of them can save significant time in your ordering and invoice management system.

Tip #7: Use the Cash Flow Planner to Predict Revenue and Expenses

Breweries of all types can benefit from the QuickBooks Cash Flow Planner. It’s a simple tool that uses your financial reports to predict revenue flowing in and expenses flowing out of your business.

Here’s the key: the planning tool only works if you’ve set up your account correctly, which is where the above best practices come back into play. Only a system hooked into and reconciled with your bank accounts, coupled with predictable recurring transactions and the right reports, can provide an accurate forecast of the cash available in the near future.

Tip #8: Connect QuickBooks With a Specialized Brewery Management Platform

On its own, QuickBooks can be a helpful tool for your brewery accounting. It certainly is a significant improvement over spreadsheets and manual recordkeeping, which take significant time and introduce room for human error. However, there’s an even better solution, especially if you’re looking to streamline all of your brewery operations: integrating QuickBooks with a specialized brewery management platform.

Even at its best, QuickBooks doesn’t fully capture the nuances of the brewery industry. Just as importantly, it functions best as an accounting platform, leaving plenty of operational requirements (from inventory tracking to batch management and production scheduling) as open needs. The solution is a platform that helps you manage all of your brewing processes.

What if that platform seamlessly integrated with QuickBooks as well? It could give you a comprehensive overview and detailed insights into production costs, expenses, revenue, and more—allowing for a more accurate assessment of profitability, margins, and other brewery-related concerns.

When it comes to QuickBooks and brewery management software, it’s not an either-or. It’s a yes-and, especially when you find a platform that naturally integrates QuickBooks into its own operations. Learn more about integrating QuickBooks with Ekos, the leading brewery management software on the market. Book a demo today.