In the second installment of our Budgeting Basics series, we’ll tackle how to build a budget for your brewery, winery, or cidery. In this article, I’ll cover the budgeting process, using the budget as a managerial tool, and how to make financial decisions using the budget.

If you missed Budgeting Basics: Part 1, you can check it out here.

Process for Building a Budget

The first thing to know about generating a budget is that sales set the tone. All other budgets flow from the sales projection.

Forecast your sales by CEs or BBLs for the trailing 12 months by beverage distributor, by SKU, and by month. (If you have a restaurant or taproom, each location should be treated as if it were a separate distributor.) Use an Excel workbook where each distributor has its own tab. Add a tab that lists the sales price per SKU by distributor. Finally, create a revenue roll-up tab in which the volume forecasted to be sold is multiplied by the correct sales price for that item per distributor.

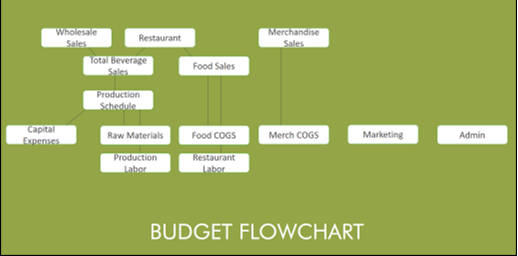

In the chart above, the top half shows revenue centers and the bottom half shows expense centers. Create a separate budget for each item on the flow chart. These will be consolidated into one master budget by the CFO.

Once revenue is agreed upon, the head brewer or production manager can use this information to make a production schedule. Following the production schedule, a raw materials, labor, and capital expenses (or “capex”) budget is built.

The restaurant or taproom manager builds out the food sales budget, from which food COGS and restaurant labor is derived. If you have someone managing merchandise, they will create their own budget. Otherwise, ask the restaurant or taproom manager to build merchandise into their budget.

Although the majority of the budget process involves P&L accounts, there are balance sheet considerations as well, primarily with capital expenses. Generally, the CFO will solicit a list of equipment requests from each department and prepare the capex budget. The CFO also prepares the administrative budget.

After all subsidiary budgets are compiled, the result is a forecasted P&L, balance sheet, and cash flow statement for the coming year.

How to Use the Budget as a Managerial Tool

Many people think of a budget as a one-time event that happens in Q4, after which it goes in a drawer never to be reviewed again until next year. This approach leaves so much value on the table. A living budget can serve as a north star, keeping a company on track all year.

It can also be used to drive accountability. In the monthly review of financials, the budget versus actual reports should be reviewed by each department so that the department head is truly held accountable for their performance. Compensation structure should be tied to the ability of the individual to manage the budget.

However, the cardinal rule of using budgeting to drive accountability is to only hold people accountable for factors within their control.

Making Financial Decisions Based on the Budget

Always think a few chess moves ahead and consider multiple options for the next course of action. For example, if you foresee capacity restraints, you might have the following options:

- Buy more equipment or build a new facility

- Find a contract brewer or custom crush facility that can make more of your product

- Keep supply unchanged but increase the sales price

- Cut production of less profitable brands or products to focus on selling more profitable items

Create a financial model for each scenario so that you can see the financial effects of each option and make an informed decision on how to proceed.

Understanding Budget vs. Actual Results

When reviewing financial results with your leaders, the purpose is not to punish department heads for being off the mark from what was budgeted; the purpose is to understand why actual results were different than what was anticipated. Ask department heads to present their own department’s results to the team. This encourages ownership.

And above all else, take action. Once you understand why a result is different than expected, change behavior or internal processes in order to influence future results.

More Budgeting Basics: Project Managing the Budgeting Process

In this post, we looked at how to build a budget at a high level. In the final installment of this series, I’ll dive deeper into how to manage every aspect of the budgeting process, including who is responsible for which parts of the budget, a proposed timeline for each task, and tips for budgeting specific aspects of your business like raw materials and a restaurant or taproom.

Stay tuned for Budgeting Basics: Part 2 — you can sign up for the Craftlab newsletter to be sure you don’t miss the latest articles.